January 21, 2026

LEM Capital Reflects on 2025 and Outlines 2026 Multifamily Investment Outlook

Philadelphia, PA – LEM Capital, L.P. (“LEM” or the “Firm”) today reflected on investing into a recalibrated market environment throughout 2025 and its optimism for 2026 as the multifamily sector faces moderating supply and more favorable capital markets.

“Throughout 2025, we observed early signs of a reset in the broader transactions market, with steadily improving momentum as capital markets began to stabilize,” said Greg Biester, Partner and Co-Head of Investments. “The shift toward a more predictable interest rate environment coupled with a falloff in new multifamily supply provided increased clarity for underwriting and valuations, and we believe this will support more consistent transaction activity moving into 2026.”

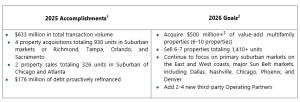

In 2025, the Firm continued to prioritize strategic portfolio management and operational discipline while selectively identifying opportunities to add to its portfolio. LEM acquired four assets (930 units) in markets with less new supply and strong market rent growth – Richmond, Suburban Chicago, Tampa, and Orlando. “We are now past what we believe was the peak of new supply in many of our markets,” said Allison Bradshaw, Partner and Co-Head of Investments. “As the pipeline continues to thin and demand remains resilient, we expect operating fundamentals to strengthen over time. This gives us confidence that being an active investor in 2026 and 2027 will be particularly fruitful. Our goal in 2026 is to deploy $150-200mm of capital across 6-10 new acquisitions.”

Operationally, LEM maintained its focus on occupancy, expenses, and business plan execution across the portfolio. The Firm also remained disciplined in evaluating potential dispositions, identifying select opportunities where asset performance, business plan maturity, and market demand aligned.

“As we look ahead, we anticipate seeking opportunities to sell assets in markets where demand is supported by strong fundamentals,” added Bradshaw. “We believe this environment will offer healthy liquidity for well-positioned properties.” Looking forward to 2026, LEM anticipates bringing 6-7 assets to market.

LEM enters 2026 with a strong capital position and a constructive outlook on the multifamily landscape. “We are optimistic about the year ahead,” said Jennifer Clausen, Partner and Head of Investor Relations. “Improving capital markets conditions, moderating supply, and a more active transactions environment set the stage for compelling opportunities. Our focus remains on identifying high-quality assets and executing our business plans alongside our Operating Partners.”

About LEM Capital

LEM Capital is a real estate private equity firm with a 23-year track record focused on protecting investors’ downside and building portfolios to help deliver dependable current cash flow and equity upside through various market cycles.

The team consists of multifamily experts that seek to acquire well-located apartment properties where LEM can add value through physical improvements and better management practices. The Firm’s approach combines the local, long-term market knowledge and day-to-day management of its nationwide network of Operating Partners with LEM’s disciplined investment selection, rigorous due diligence process, and intensive asset management oversight. LEM’s goal is to deliver attractive risk-adjusted returns to its investors while safeguarding capital.

Since 2002, LEM has raised approximately $1.8 billion in investor commitments and invested over $9.2 billion in real estate, contributing to its expertise in structuring, execution, and asset management. This includes acquiring more than 28,000 value-add apartment units since 2011.

Notes – All data as of December 31, 2025, unless otherwise noted. 1Represents total real estate volume (sales, acquisitions, and refinances). 2 The current outlook of LEM Capital as of December 31, 2025. There can be no assurance these goals will be achieved. 3 Total Capitalization.